The economic news on Friday for the White House was great and historic and continued the success of the Joe Biden administration forever and cemented his place as the greatest economic president ever. No, it did not. It was touted as a win by the White House that job applications and unemployment were improving while inflation continued to rise, and Americans were typically less well off. Oh, and throw in a bank failure, the largest since 2008 and we got conflicting sentiment.

The economy and the White House are always interlinked and James Carville’s “it’s the economy stupid” quote has been said over and over to death during every analysis on every DC show. George W Bush also said “you’re playing defense all the time, especially with the economy…” so it’s helpful to have an ally when playing defense against something. What better ally than the media!

WHAT TO LOOK OUT FOR IN ECONOMIC NEWS MEDIA

So what are the common mistakes we make when we ingest economic news? One thing is letting someone else doing the thinking for us. We let the pundit on the TV tell us that all is good, while a DOZEN EGGS COST MORE THAN GAS, and 1/3 of San Diego homeowners are NOT PAYING THEIR MONTHLY UTILITY BILL, because of rising costs. Those are good signs for the economy? Which category do those 2 singular news stories fall under? But there are other pitfalls to be aware of when it comes to Economic reporting:

Selective reporting: Media outlets often report on economic data that supports their own biases or political views. They may ignore or downplay data that contradicts their preconceptions. For example, a left-leaning media outlet might report on rising income inequality but fail to mention that overall standards of living are improving. Similarly, a right-leaning outlet might tout low unemployment numbers but ignore the fact that wages are stagnant.

Sensationalism: The media often sensationalizes economic news to grab readers’ attention. This can lead to distorted or exaggerated reporting that paints an inaccurate picture of the economy. For example, headlines might scream about a “stock market crash” when in reality, the market has only experienced a minor correction.

Lack of context: Economic reporting often lacks context, which can lead to misunderstandings and confusion among readers. For example, a report might mention that the economy grew by 2% in a given quarter, but fail to explain what that actually means in terms of real-world outcomes like job creation, inflation, and consumer spending.

Ignoring long-term trends: The media tends to focus on short-term economic data like monthly job reports or quarterly GDP growth rates. While these are important indicators of economic health, they don’t tell the whole story. Long-term trends like demographic shifts, technological changes, and globalization are often ignored or downplayed in media coverage.

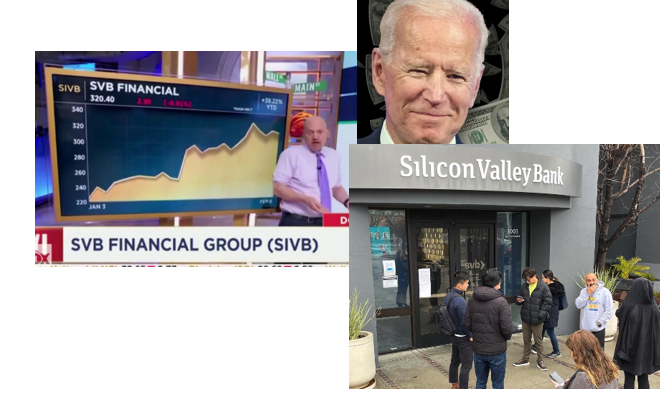

THE JIM CRAMER CURSE

In addition there are experts who will profit from steering us into different directions or in the direction they want us. Without knowing the Jim Cramer portfolio and how he truly earns his “Mad Money” you have to simply google the Jim Cramer Curse. The Cramer curse has created a stock Fund that actually allows you to invest on the short-term success or failure of Jim Cramer stock picks. What is the “Jim Cramer curse” it’s a phenomenon in the stock market where stocks that are recommended by Jim Cramer, the host of CNBC’s “Mad Money,” tend to underperform in the short-term after his endorsement. The curse refers to the idea that investors who follow Cramer’s advice are likely to lose money. For a fun experiment Google Jim Cramers Take on SILICON VALLEY BANK a few weeks before it’s collapse!

HOW DO YOU GET SMARTER ABOUT ECONOMIC NEWS

There are several ways, but it’s going to take work. Public education and education in general have woefully underperformed when it came to educating the masses in economics. Why is that? Is it because there is a value in having an American Public unable to understand economic trends, investments, and careful money management? By the amount of dollars given to Washington DC from the large banks, Wall Street, and investment firms, YOU’RE DAMN RIGHT THERE IS! So, take your energy drink and sign up for some online classes you can take from home and learn about the economy:

Take an online course or class: There are many online courses and classes available that can help you learn more about economics. Websites like Coursera or edX offer courses from top universities that cover a wide range of economic topics, from microeconomics to international trade.

Read books on economics: There are many excellent books on economics that can help you deepen your understanding of the subject. Some classics include “The Wealth of Nations” by Adam Smith, “The General Theory of Employment, Interest, and Money” by John Maynard Keynes, and “Freakonomics” by Steven Levitt and Stephen Dubner.

Join an economics club or group: Joining an economics club or group can provide a forum for discussing economic issues and learning from others. You can find local groups through websites like Meetup or join online forums and discussion groups to connect with others who share your interest in economics.

Practice applying economic concepts: One of the best ways to get smarter about economics is to practice applying economic concepts to real-world situations. Look for examples of economic principles in action, like how supply and demand affect the price of goods or how government policies impact the economy. Try to think critically about these examples and how they relate to broader economic trends and theories.

REDDIT ECONOMIC UNIVERSITY

For those with a PHD in Reddit which is probably one of the greatest sources of information (also with skepticism and using your own best judgement) here are some threads to consider:

- r/Economics: This subreddit is dedicated to discussing news and research related to economics, with a focus on academic and policy-oriented content.

- r/AskEconomics: This subreddit is a place to ask questions and seek explanations about economic concepts and theories from experts and enthusiasts.

- r/investing: This subreddit is focused on investing and financial markets, with discussions on stocks, bonds, commodities, and more.

- r/StockMarket: This subreddit is dedicated to discussing news and analysis related to the stock market, including individual companies and market trends.

- r/personalfinance: This subreddit is focused on personal finance and budgeting, with discussions on saving money, investing, and managing debt.

It’s important to note that while these forums can be helpful for learning about the economy and investing, it’s always a good idea to approach information critically and do your own research to ensure accuracy and relevance to your individual situation.

Please consider the sources of your financial media and information and don’t always believe in conventional wisdom. When the consensus of something as large as the economy says it’s going great, take a moment to look around you and decide for yourself if you think it’s going great for those around you. Listening to so many podcasts and seeing news painting a rosy picture lately, made me stop and say, I know multiple people unemployed, and underemployed, I know how much gas and utility bills. I see the homeless trend, and how close we all are to being homeless with a few bad months, and something just doesn’t pass the smell test. Question everything, live Socratically economically!

Leave a comment